Maximum 403b Contribution 2025. Learn about the contribution limits for 403(b) retirement plans in 2025. $23,000 (was $22,500 in 2025).

The internal revenue service recently announced the annual 403 (b) limits for 2025. This is the total amount that you can contribute to your 403 (b) plan from your salary before taxes.

How Much Can You Contribute To A 403b In 2025 Viki Almeria, What is the maximum 403b contribution 2025. Employees age 50 or older may contribute up to an additional $7,500.

403 B Max Contribution 2025 Over 55 Nat Laurie, $23,000 (was $22,500 in 2025). $23,000 (was $22,500 in 2025).

401k And 403b Contribution Limits 2025 Cristy Melicent, The annual limit on contributions will increase to $23,000 (up from $22,500) for 401(k), 403(b) and 457. The annual elective deferral limit for 403 (b) plan employee contributions is increased to $23,000 in 2025.

403b And 457 Contribution Limits 2025 Moina Terrijo, 401k max catch up contribution 2025. Max 403b contribution 2025 catch up.

2025 Irs 403b Contribution Limits Catlee Alvinia, The annual 403 (b) contribution limit for 2025 has changed from 2025. The 403 (b) contribution limit refers to the maximum amount that an individual can contribute annually to their 403 (b) retirement savings plan.

403b Contribution Limits 2025 Calculator In Sybil Kimberlyn, The overall 401 (k) limits. The annual elective deferral limit for 403 (b) plan employee contributions is increased to $23,000 in 2025.

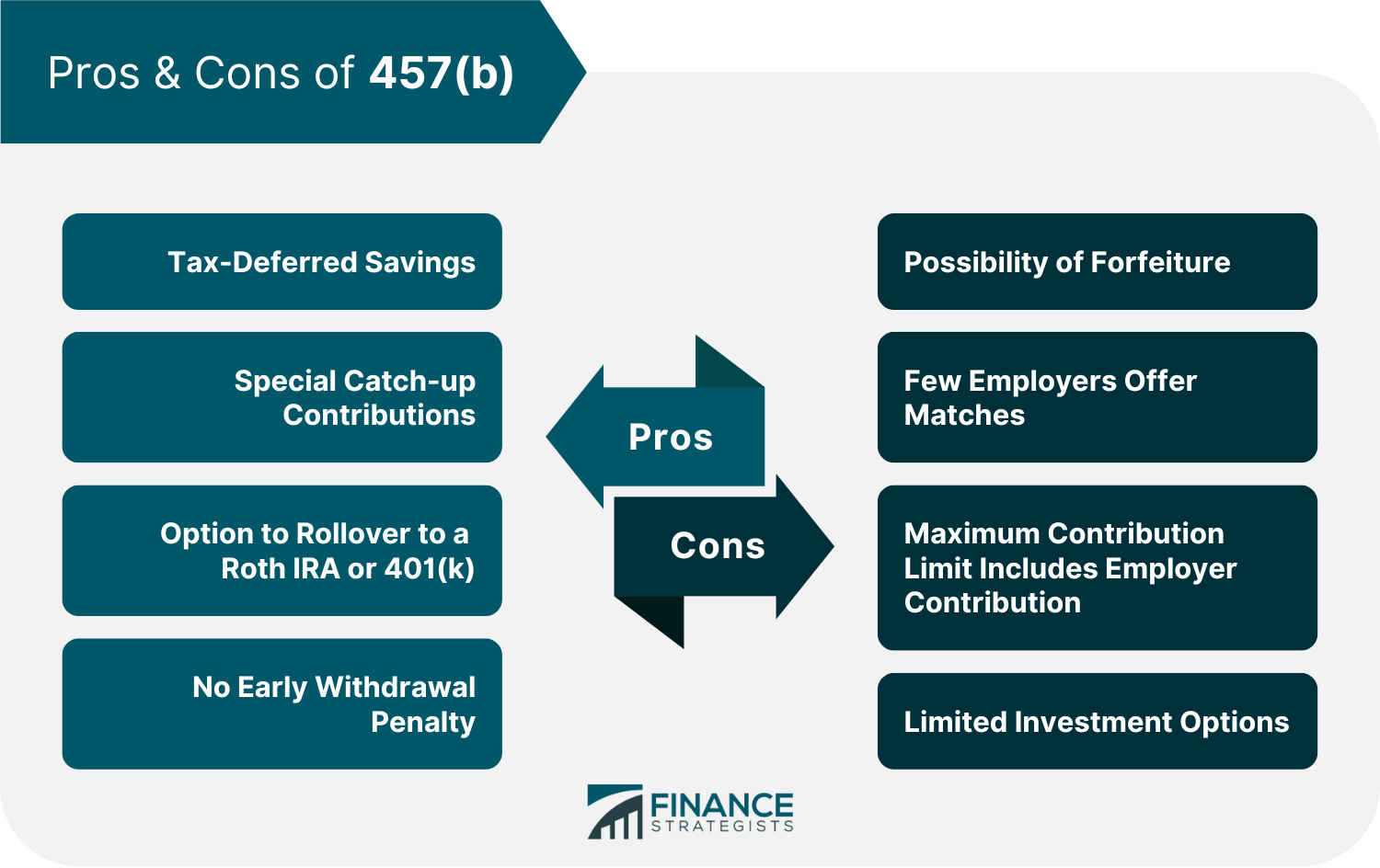

Max 403b Contribution 2025 Terza, 401k max catch up contribution 2025. In 2025, eligible employees who elect to make deferrals to both a 403 (b) and 457 (b) plan will generally be able to contribute up to $23,000 in deferrals to their.

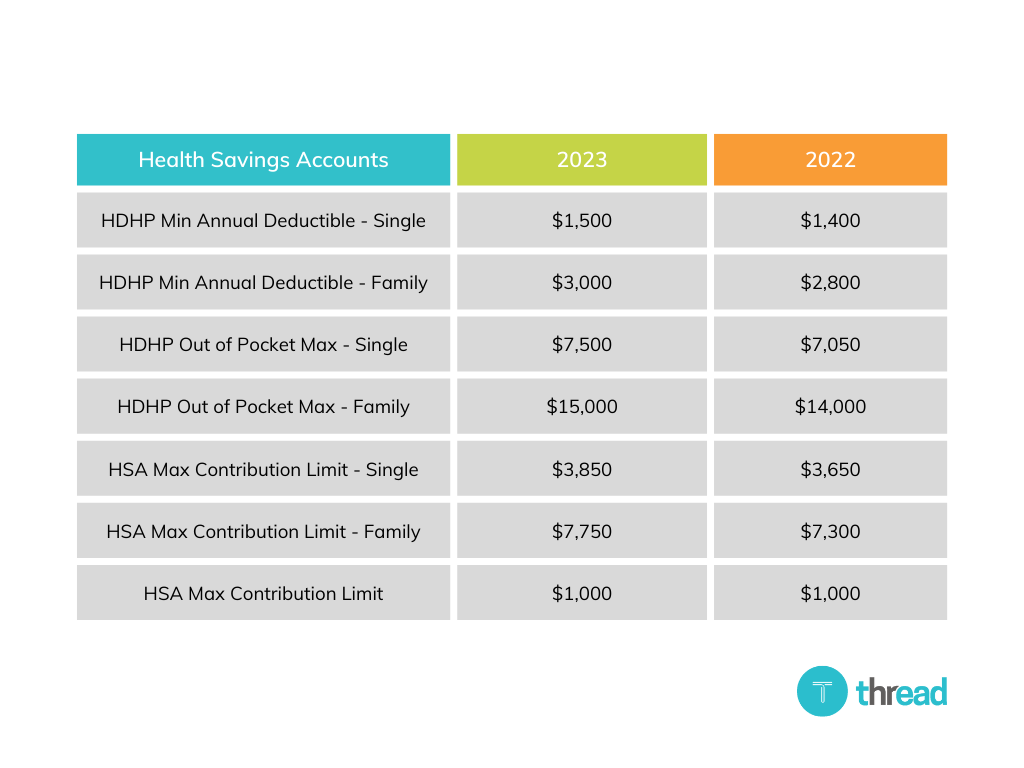

2025 Contribution Limits For IRA, 401(k), HSA, FSA, 403(b), 457(b, For help using the calculator,. 403(b) irs contribution limits for 2025 for 2025, the 403(b) max contribution limit is $22,500 for pretax and roth ira contributions.

Irs 403b Contribution Limits 2025 Ilse Rebeca, For help using the calculator,. However, the total combined contributions, including both employee elective deferrals and.

403(b) Contribution Limits for 2025, The annual elective deferral limit for 403 (b) plan employee contributions is increased to $23,000 in 2025. The annual 403 (b) contribution limit for 2025 has changed from 2025.